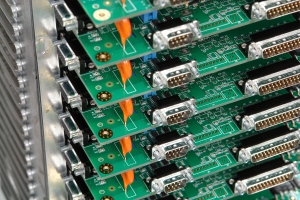

The Tariff Situation and PCB Sourcing

December 7, 2018 Leave a comment

As we write this, the tariff situation seems to be improving. The 25% jump in tariffs planned for January has been postponed 90 days, pending the result of ongoing negotiations with China. That said, there is a 10% tariff on printed circuit boards (PCBs) fabricated in China. Even with the 10% tariff, in many cases, China remains the most competitive option. Should the tariffs jump to 25%, that would no longer be the case. The team at Burton Industries is in the process of qualifying Taiwanese PCB options to ensure our customers have a range of cost competitive options.

As we write this, the tariff situation seems to be improving. The 25% jump in tariffs planned for January has been postponed 90 days, pending the result of ongoing negotiations with China. That said, there is a 10% tariff on printed circuit boards (PCBs) fabricated in China. Even with the 10% tariff, in many cases, China remains the most competitive option. Should the tariffs jump to 25%, that would no longer be the case. The team at Burton Industries is in the process of qualifying Taiwanese PCB options to ensure our customers have a range of cost competitive options.